Casual Taxable Persons – GST Registration

Casual taxable persons have been provided special treatment under GST. The GST Act defines as casual taxable person as a person who occasionally undertakes transactions involving supply of goods or services or both in the course or furtherance of business, whether as principal, agent or in any other capacity, in a State or a Union territory where he has no fixed place of business. Hence, persons running temporary businesses in fairs or exhibitions or seasonal businesses would fall under casual taxable persons under GST. In this article, we look at GST registration for casual taxable persons.

Regular Taxable Persons vs Casual Taxable Persons

A regular taxable person would be someone who is required to be registered under GST and not classifiable as a casual taxable person or non-resident taxable person. Hence, regular taxable persons would be someone with a fixed place of business located within India.

Unless a regular tax payer is enrolled under the GST composition scheme, the taxpayer would be required to file monthly GST returns, maintain accounts as per GST Act, maintain a fixed place of business and comply with GST regulations.

Casual taxable persons would find it hard to maintain a fixed place of business or file monthly GST returns continuously, as their business would be seasonal in nature with no fixed place of business. To accommodate the unique requirements of such taxpayers, special provisions have been provided under the GST Act for registration of casual taxable persons.

GST Registration for Casual Taxable Persons

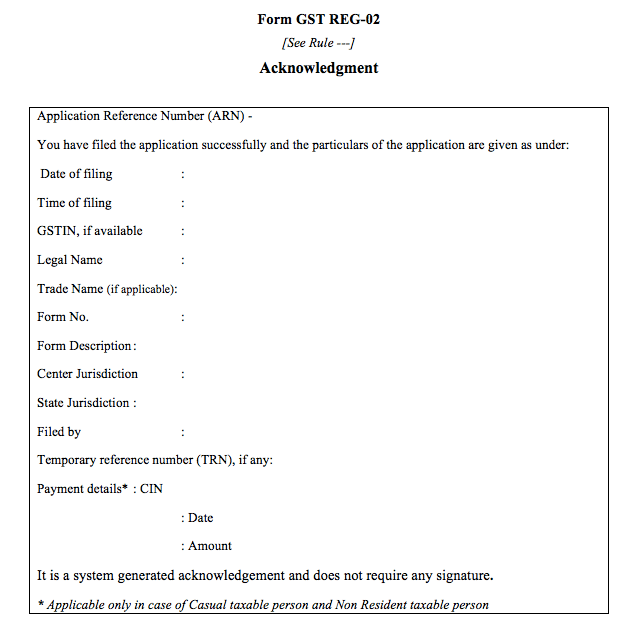

All persons who are classified as casual taxable persons are mandatorily required to obtain GST registration, irrespective of the annual aggregate turnover. Further, the application for GST registration for a casual taxable person must be made atleast 5 days prior to the commencement of business. GST registration application for casual taxable persons can be made using FORM GST REG-01.

Deposit for GST Registration

Unlike regular taxpayers, casual taxable persons are required to deposit tax in advance for GST registration. The amount of tax to be deposited would be equal to the expected tax liability during the validity period of GST registration. Hence on applying for GST registration, a temporary reference number is generated for payment of GST deposit. On paying the GST deposit, the electronic cash ledger of the taxpayer is credited and GST registration certificate is released. (Know more about amount of deposit required for GST registration)

Validity of GST Registration for Casual Taxable Persons

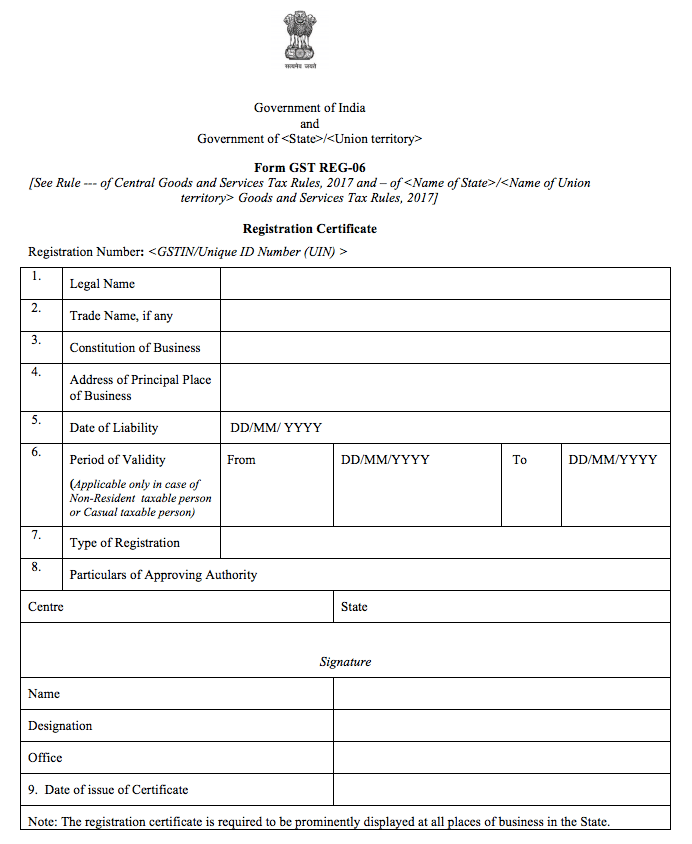

The validity of GST registration for a casual taxable persons is the validity period specified in the GST registration application or 90 days from the date of registration, whichever is earlier. The sample GST registration certificate below shows validity period being specified only for casual taxable persons and non-resident taxable persons under GST.

Extension of GST Registration for Casual Taxable Persons

In case a casual taxable person needs extension of the validity period mentioned in the GST registration certificate, then FORM GST REG-11 must be submitted. Along with the request for extension of validity period, advance GST deposit must also be made by the taxpayer based on the expected tax liability. If the officer verifying the application is satisfied and advance GST deposit is made, the GST registration can be extended by upto another 90 days.

The post Casual Taxable Persons – GST Registration appeared first on IndiaFilings.com | Learning Center.