GSTR-3 Filing – GST Return Due on 20th

GSTR-3 is a type of GST return that must be filed by regular taxpayers on the 20th of every month. GSTR-3 filing can be made on the GST Common Portal after filing GSTR-1 and GSTR- 2 for the month. If GSTR-1 return is not filed, then GSTR-2 return cannot be filed. Hence, all regular taxpayers must file GST returns regularly every month starting with GSTR-1 filing, followed by GSTR-2 and GSTR-3 return filing. In this article, we look at GSTR-3 return filing in detail.

Who should file GSTR-3 returns?

GSTR-3 return must be filed by all regular taxpayers registered under GST. In India, any person undertaking taxable supply of goods and services over Rs.20 lakhs in most states are required to be registered under GST. In some special category states, the aggregate turnover limit has been fixed at Rs.10 lakhs.

In addition to the aggregate turnover criteria, some types of taxable persons under GST like casual taxable persons and non-resident taxable persons are required to mandatorily obtain GST registration, irrespective of annual turnover criteria. Casual taxable persons and non-resident taxable persons are not required to file GSTR-3 filing. GSTR-3 return must be filed by regular taxpayers only. (Check GST registration eligibility).

What details must be provided in GSTR-3 filing?

GSTR-3 return is filed after filing of GSTR-1 and GSTR-2 returns. Most of the information to be filed in GSTR-3 return will be auto-populated based on GSTR-1 and GSTR-2 filings. Only some of the information will have to be verified, edited or added by the taxpayer.

The following information in GSTR-3 filing will be auto-populated:

- Turnover

- Outward supplies

- Inter-State supplies (Net Supply for the month)

- Intra-State supplies (Net supply for the month)

- Tax effect of amendments made in respect of outward supplies

- Inward supplies attracting reverse charge including import of services (Net of advance adjustments)

- Inward supplies on which tax is payable on reverse charge basis

- Tax effect of amendments in respect of supplies attracting reverse charge

- Input tax credit

- ITC on inward taxable supplies, including imports and ITC received from ISD [Net of debit notes/credit notes]

- Addition and reduction of amount in output tax for mismatch and other reasons

- Total tax liability

- Credit of TDS and TCS

- Interest liability

- Late Fee

The following information must be provided by the taxpayer for GSTR-3 filing:

- Tax payable and paid

- Interest, Late Fee and any other amount (other than tax) payable and paid

- Refund claimed from Electronic cash ledger

- Debit entries in electronic cash/Credit ledger for tax/interest payment

What is the due date for filing GSTR-3 return?

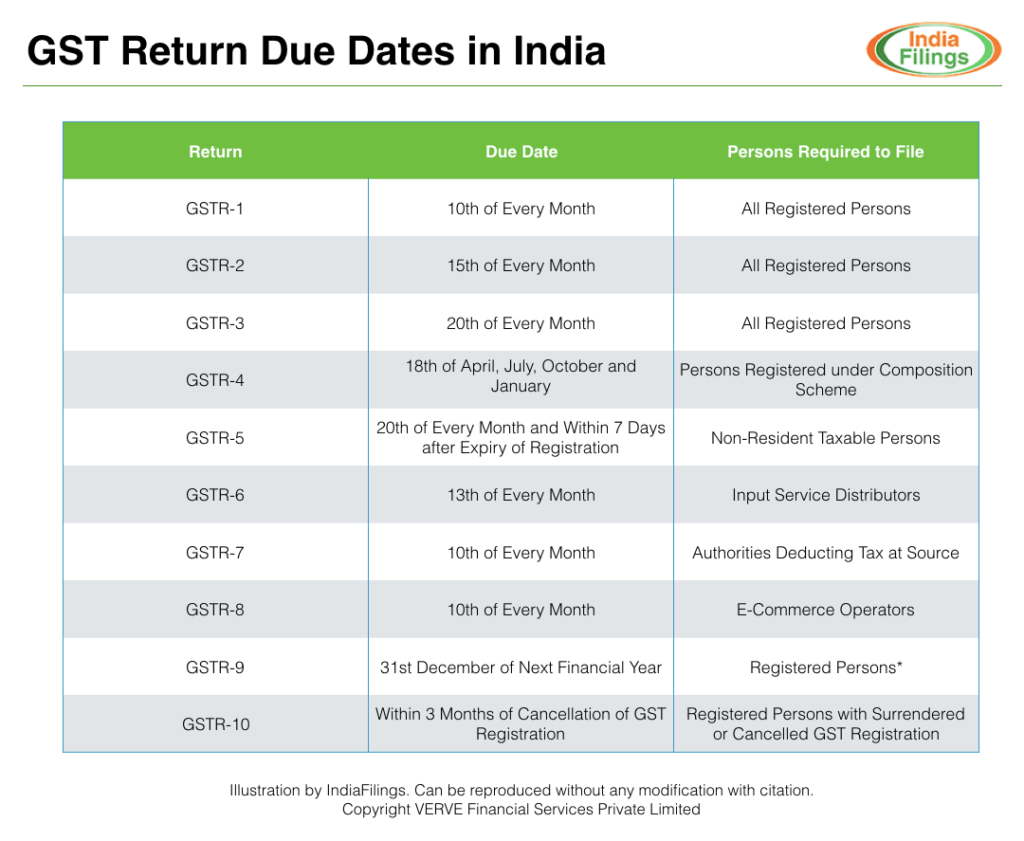

All regular taxpayers must file GSTR-3 return before the 20th of every month. Before filing GSTR-3 return, GSTR-1 and GSTR-2 return must be filed. If GSTR-1 and GSTR-2 return are not filed, the GST common portal will not allow the taxpayer to file GSTR-3 return. The due dates for filing of GST returns for regular taxpayers are as follows:

What is the penalty for late filing of GSTR-3 return?

A penalty of Rs.100 per day upto a maximum of Rs.5000 can be levied for late filing of any GST return. If GSTR-3 return is not filed, a penalty of Rs.100 per day will be applicable. If GSTR-1 and GSTR-2 return are also not filed, then a penalty of Rs.300 per day would be applicable.

How to file GSTR-3 return?

GSTR-3 return can be filed online on the GST Common Portal. The taxpayer can login to their GST common portal account, verify the auto-populated information, edit and add other information to file the return. GSTR-3 return must be digitally signed by the authorised person mentioned on the GST account. You can also file GST return through LEDGERS GST Software online.

The post GSTR-3 Filing appeared first on IndiaFilings.com | Learning Center.